Aerodrome Finance represents a groundbreaking decentralized exchange protocol built on the Base blockchain, engineered to become the central liquidity hub for the entire ecosystem. This innovative platform combines advanced automated market maker technology with sophisticated incentive mechanisms, positioning Aerodrome Finance as a critical infrastructure component for next-generation decentralized finance. By leveraging Base's scalability and cost-efficiency, Aerodrome Finance delivers unprecedented transaction speeds while maintaining robust security protocols. The core mission driving Aerodrome Finance forward focuses on creating sustainable, deep liquidity pools that benefit both retail participants and institutional DeFi users alike.

At its technological core, Aerodrome Finance employs an enhanced automated market maker model that significantly improves upon traditional constant product formulas. The protocol's architecture incorporates concentrated liquidity features, allowing liquidity providers to specify price ranges for their capital deployment. This precision within Aerodrome Finance translates to superior capital efficiency, often achieving multiples higher than conventional decentralized exchanges. Furthermore, Aerodrome Finance integrates flash swap capabilities and advanced routing algorithms that minimize slippage across complex multi-hop transactions. The entire Aerodrome Finance ecosystem operates through non-upgradable smart contracts that have undergone extensive third-party auditing, ensuring fund security remains paramount.

The AERO token serves as the fundamental economic engine powering Aerodrome Finance's operations. Designed with deflationary characteristics, AERO incorporates sophisticated token burning mechanisms triggered by various platform activities. Aerodrome Finance distributes emissions strategically to liquidity providers who stake their LP tokens, creating powerful alignment between long-term participants and protocol health. What distinguishes Aerodrome Finance is its innovative vote-lock mechanism: AERO holders can lock their tokens to receive vlAERO, which grants governance rights and entitles holders to protocol revenue distribution. This elegant tokenomics design within Aerodrome Finance ensures that value accrual benefits the most committed stakeholders.

Aerodrome Finance operates as a fully decentralized autonomous organization where vlAERO holders exercise control over critical protocol parameters. Governance participants in Aerodrome Finance can propose and vote on emission distribution across liquidity pools, fee structure adjustments, treasury management strategies, and technical upgrades. The voting power within Aerodrome Finance correlates directly with both the quantity of locked tokens and the duration of the lock period, incentivizing long-term alignment. This governance framework establishes Aerodrome Finance as a community-steered project where major decisions undergo transparent deliberation and voting procedures.

Aerodrome Finance provides comprehensive liquidity solutions through its diverse array of incentivized pools spanning major stablecoins, blue-chip cryptocurrencies, and emerging Base ecosystem tokens. Liquidity providers on Aerodrome Finance benefit from dual revenue streams: trading fee generation typically set between 0.01% to 1% per transaction, supplemented by AERO emissions distributed proportionally to staked LP positions. The platform's unique gauge weight voting allows the Aerodrome Finance community to direct incentives toward the most strategically valuable pools. Additionally, Aerodrome Finance incorporates specialized features like fee rebates for selected partners and whitelisted pools with concentrated liquidity for institutional participants.

Aerodrome Finance introduces several proprietary technological advancements including its custom-built routing engine that scans all possible paths between trading pairs to identify optimal execution. The protocol's smart order architecture within Aerodrome Finance minimizes MEV extraction risks through sophisticated transaction batching and front-running resistance mechanisms. For developers, Aerodrome Finance offers comprehensive API access and SDK tools that simplify integration processes. The platform's immutable smart contracts ensure that Aerodrome Finance operates without administrative keys or centralized control points, embodying true decentralization principles while maintaining upgradeability through community governance processes.

Aerodrome Finance strategically positions itself as Base's primary liquidity layer, forming symbiotic relationships with lending protocols, yield aggregators, and derivative platforms across the ecosystem. The protocol's flywheel effect attracts TVL which in turn enhances trading efficiency, drawing more users to Aerodrome Finance and creating a self-reinforcing growth cycle. Numerous projects leverage Aerodrome Finance for initial token distribution and liquidity bootstrapping, utilizing the platform's liquidity gauge incentives. This strategic importance makes Aerodrome Finance an indispensable component of Base's infrastructure, with its health directly correlating to the broader ecosystem's development trajectory.

Security within Aerodrome Finance receives paramount attention through multiple protective layers. The protocol's battle-tested codebase originates from rigorous audits conducted by leading blockchain security firms, with ongoing bug bounty programs incentivizing continuous scrutiny. Aerodrome Finance implements time-lock mechanisms for sensitive operations and maintains a decentralized treasury controlled by multi-signature governance. The platform's economic security model ensures that potential attack vectors become financially nonviable, while emergency response protocols allow Aerodrome Finance to rapidly address unforeseen vulnerabilities through coordinated community action.

When benchmarked against competitors, Aerodrome Finance demonstrates superior capital efficiency through its concentrated liquidity implementation, enabling LPs to achieve higher returns with equivalent capital. The protocol's fee structure within Aerodrome Finance remains highly competitive, with customizable tiers accommodating different asset classes. Unlike many decentralized exchanges, Aerodrome Finance offers sustainable yield generation not solely dependent on token emissions, thanks to its substantial fee revenue and tokenomics design. The platform's seamless integration with Base's native bridge and growing partner ecosystem provides Aerodrome Finance with distinct network effects that compound its competitive positioning.

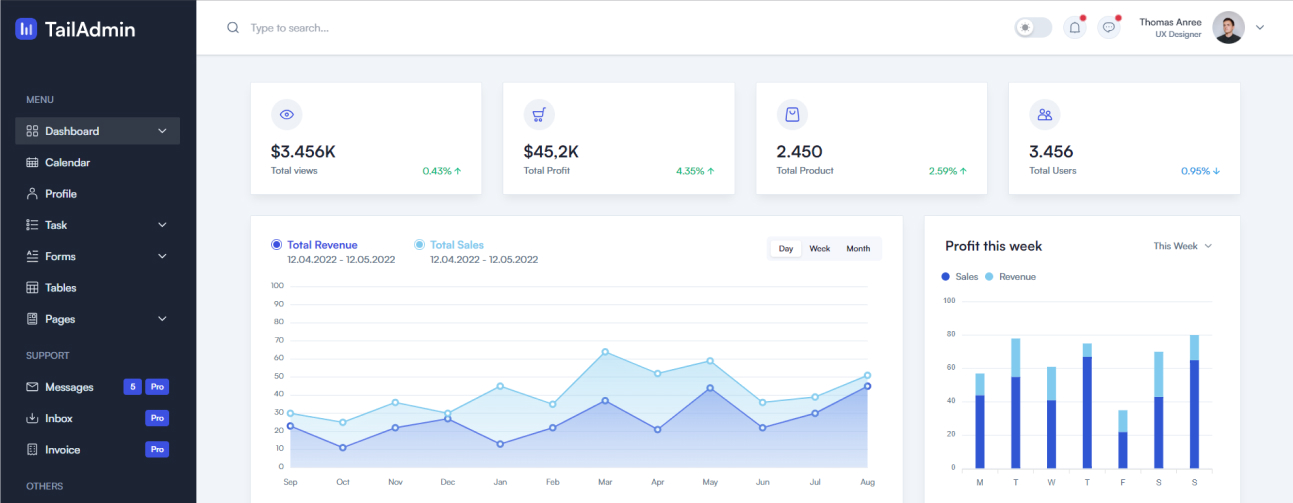

Aerodrome Finance prioritizes intuitive user experience without compromising on advanced functionality. The interface presents clear visualizations for impermanent loss projections, yield forecasting, and position management. Users navigating Aerodrome Finance benefit from gas optimization features that batch transactions and estimate optimal execution times. The platform incorporates comprehensive analytics dashboards displaying real-time metrics across all pools within Aerodrome Finance. For institutional participants, Aerodrome Finance offers specialized interfaces with API connectivity and customized reporting tools that streamline treasury operations and compliance requirements.

The development trajectory for Aerodrome Finance includes cross-chain expansion initiatives that will extend the protocol's liquidity network beyond Base while maintaining its core infrastructure. Upcoming technical enhancements to Aerodrome Finance focus on implementing dynamic fees that automatically adjust based on market volatility and liquidity depth. The roadmap includes sophisticated risk management modules for institutional adoption and layer-2 integrations to further optimize transaction economics. Aerodrome Finance will introduce veNFT innovations allowing transferable voting rights and delegated governance features. Long-term vision for Aerodrome Finance encompasses becoming the liquidity backbone for the entire Ethereum rollup ecosystem through strategic partnerships and technical interoperability standards.

Aerodrome Finance demonstrates remarkable versatility through its integrations across DeFi verticals. Lending platforms utilize Aerodrome Finance as primary liquidity source for asset collateralization, while yield optimizers automatically compound rewards generated through Aerodrome Finance positions. The protocol serves as price discovery mechanism for new assets launching on Base, with projects frequently allocating significant token allocations to Aerodrome Finance liquidity mining programs. Bridge protocols leverage Aerodrome Finance's deep liquidity pools to minimize slippage for cross-chain transfers. These integrations collectively reinforce Aerodrome Finance's position as fundamental infrastructure rather than merely a trading venue.

Aerodrome Finance achieves remarkable economic sustainability through its multi-revenue stream model combining trading fees, protocol-owned liquidity yields, and strategic partnership income. The deflationary pressure exerted by token burning mechanisms within Aerodrome Finance creates natural scarcity as platform usage increases. Protocol-controlled value accumulation allows Aerodrome Finance to maintain reserves for strategic initiatives and market downturns. The vote-lock mechanics ensure that long-term stakeholders in Aerodrome Finance benefit proportionally from protocol success, aligning incentives across all participant categories. This comprehensive economic design positions Aerodrome Finance for longevity regardless of market cycles.

Aerodrome Finance actively cultivates its developer ecosystem through comprehensive documentation, dedicated grant programs, and technical workshops. The protocol's smart contracts are designed for seamless composability, enabling developers to build innovative applications atop Aerodrome Finance infrastructure. Several derivative protocols have launched utilizing Aerodrome Finance's oracle feeds and liquidity depth. The growing suite of tools around Aerodrome Finance includes analytics dashboards, yield optimization strategies, and risk management frameworks. This thriving developer activity surrounding Aerodrome Finance continuously expands the protocol's utility frontier and strengthens its network effects.

Aerodrome Finance develops specialized features catering to institutional requirements including whitelisted pools with custom parameters, compliance-friendly reporting outputs, and integration frameworks for treasury management systems. The protocol's transparent operations and verifiable on-chain data within Aerodrome Finance provide necessary audit trails for regulated entities. Several venture funds and market makers actively participate in Aerodrome Finance liquidity provision programs, attracted by the sophisticated risk-adjusted return profiles. The institutional embrace of Aerodrome Finance validates its robustness while bringing professional market depth that benefits all participants in the ecosystem.

The success of Aerodrome Finance fundamentally stems from its vibrant, engaged community that actively participates in governance, education initiatives, and ecosystem development. Community members contribute to Aerodrome Finance through localized educational content creation, technical support in developer forums, and grassroots awareness campaigns. Regular community calls within the Aerodrome Finance ecosystem facilitate transparent communication between core contributors and stakeholders. The protocol's governance mechanisms ensure that Aerodrome Finance evolves according to collective community wisdom rather than centralized decision-making. This community-centric approach makes Aerodrome Finance exceptionally resilient and adaptable to changing market dynamics.

Aerodrome Finance demonstrates impressive traction through key performance indicators including consistent total value locked growth, expanding daily trading volumes, and increasing unique participant counts. The protocol maintains healthy liquidity depth across major trading pairs within Aerodrome Finance, with tight bid-ask spreads rivaling centralized exchanges. Emissions efficiency metrics show Aerodrome Finance generating substantial trading fee revenue relative to token incentives distributed. User retention rates within Aerodrome Finance significantly outperform industry averages, indicating strong product-market fit. These metrics collectively validate Aerodrome Finance's value proposition and execution effectiveness.

Aerodrome Finance invests significantly in educational initiatives including comprehensive documentation portals, video tutorial series, and interactive platform simulations. The community support structure around Aerodrome Finance includes dedicated help desks, moderated discussion forums, and real-time technical assistance channels. Regular workshops hosted by Aerodrome Finance cover topics ranging from basic liquidity provision to advanced governance participation strategies. These resources lower entry barriers while empowering users to maximize their Aerodrome Finance experience. The protocol's commitment to education reflects its long-term orientation and community empowerment philosophy.

Aerodrome Finance establishes itself as indispensable DeFi infrastructure through its unique combination of capital efficiency, sustainable tokenomics, and community governance. The protocol's technical innovations within Aerodrome Finance solve critical liquidity fragmentation issues while its economic design aligns long-term incentives across stakeholders. As Base ecosystem growth accelerates, Aerodrome Finance stands positioned to capture increasing value as the dominant liquidity layer. The continuous development trajectory of Aerodrome Finance promises further enhancements that will expand its utility frontier. For participants seeking exposure to decentralized finance infrastructure with robust fundamentals, Aerodrome Finance presents a compelling opportunity with network effects that strengthen as adoption increases.

Search on Youtube!Multidisciplinary Web Template Built with Your Favourite Technology - HTML Bootstrap, Tailwind and React NextJS.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

The main 'thrust' is to focus on educating attendees on how to

best protect highly vulnerable business applications with

interactive panel discussions and roundtables led by subject

matter experts.

The main 'thrust' is to focus on educating attendees on how to

best protect highly vulnerable business applications with

interactive panel.

There are many variations of passages of Lorem Ipsum but the majority have suffered in some form.

Start using PlayThere are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Up to 1 User

All UI components

Lifetime access

Free updates

Recommended

BasicUp to 1 User

All UI components

Lifetime access

Free updates

Up to 1 User

All UI components

Lifetime access

Free updates

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

It takes 2-3 weeks to get your first blog post ready. That includes the in-depth research & creation of your monthly content ui/ux strategy that we do writing your first blog post.

There are many variations of passages of Lorem Ipsum available but the majority have suffered alteration in some form.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

401 Broadway, 24th Floor, Orchard Cloud View, London

We value your privacy. We do not sell personal data. We may process limited technical data to improve service quality. Contact us for data access or deletion requests.

By using this website, you agree to comply with applicable laws and refrain from abusive or illegal activities. The service is provided “as is” without warranties.

Digital services are generally non-refundable once delivered. If you believe a charge was made in error, please contact support within 14 days.